SADC and the AfCFTA

The Southern African Development Community (SADC), comprising of 16 member states1, is one of the eight regional economic communities (RECs) recognised by the African Union as building blocks for the African Economic Community. It. SADC was established in August 1992 in Windhoek, Namibia, and is committed to regional integration and poverty eradication through economic development and ensuring peace and security.

The region has been implementing a free-trade area since 2008, through the SADC Protocol on Trade (STP). The region’s integration effort is guided by the Regional Indicative Strategic Development Plan 2020-2030, which is a comprehensive framework guiding the regional integration agenda.

The SADC Protocol on Trade in Services, which entered into force in 2021, plays a pivotal role in promoting regional integration and facilitating trade in services within the SADC region. The first round of sectoral negotiations currently covers six sectors (communication, financial services, tourism, transport, construction, energy-related services) and negotiations on the remaining sectors are yet to commence.

To fully leverage the advantages of the AfCFTA and effectively support its implementation processes, the private sector must make informed decisions to harness the benefits offered by the agreement, while at the same time navigating through the challenges that may arise during its implementation.

All SADC member states have signed the African Continental Free Trade Area (AfCFTA) agreement, though it has not been ratified by all. Although AfCFTA negotiations are member states-driven, the SADC Secretariat has a role in coordinating member states in AfCFTA processes to ensure the agreement builds on SADC principles, taking into consideration the rights and obligations in the STP.

Challenges to implementing the AfCFTA in SADC

The EAC Secretariat has embarked on capacity building and awareness creation for all stakeholders on the provisions and opportunities of doing business under the AfCFTA.

However, the business community in the EAC requires more than the historical background, legal text and potential impact of the AfCFTA. It needs to know what it takes to trade under the AfCFTA; the details of offers made by respective partner states in the EAC region; the actual demand in the markets offered through the agreement; and logistical requirements. The AfCFTA’s trade opportunities have to be translated into what makes business sense.

There has been considerable progress in the EAC region regarding the AfCFTA, with input from the GIZ. So far, a joint offer for trade in goods and an initial offer for trade in services have been developed and submitted to the African Union Commission. And capacity building has been facilitated among customs officials and the private sector to foster a clear understanding of the offers made, market demand and other requirements.

Niger’s full participation in intra-African trade as well as the implementation of the agreement pose challenges that are both multifaceted and complex for the country.

Indeed, to take full advantage of the AfCFTA, Niger must respond to the following challenges:

The GIZ programme in the SADC focuses on five thematic areas:

Strengthening the steering and coordination capacities of AfCFTA negotiation and implementation

Facilitating trade-in-services negotiations

Supporting the implementation of obligations under trade in goods

Promoting socially, ecologically and economically sustainable realisation of the AfCFTA

Supporting preparation for Phase II negotiations

The programme also supports the active involvement of the private sector and civil society in the implementation of the AfCFTA. It works

across three levels: continental, regional and national.

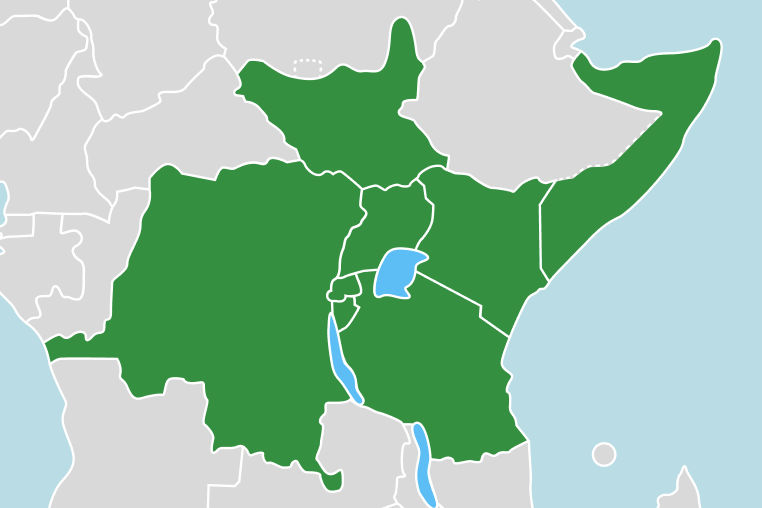

At the regional and national levels, the programme provides support to three RECs – the East African Community, Economic Community of West African States and SADC – as well as 10 AU member states.

Expected programme results

The expected results are:

Facts and figures

The AfCFTA will help SADC boost its intra-African trade, which it is intent on growing.

In 2019, the total merchandise trade of SADC stood at USD 362.43 million, with intra-SADC merchandise trade at USD 81.27 million and extra-SADC merchandise trade at USD 281.15 million*

China was SADC’s main trading partner for exports*

SADC chiefly imports manufactured products and exports minerals, precious stones and metals, with total merchandise export for the region at USD 181 815 million in 2019

*Provisional statistics *SADC Merchandise Trade Statistics Bulletin for November 2021

Our partners in SADC

Political partner: SADC Secretariat